“We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten”.

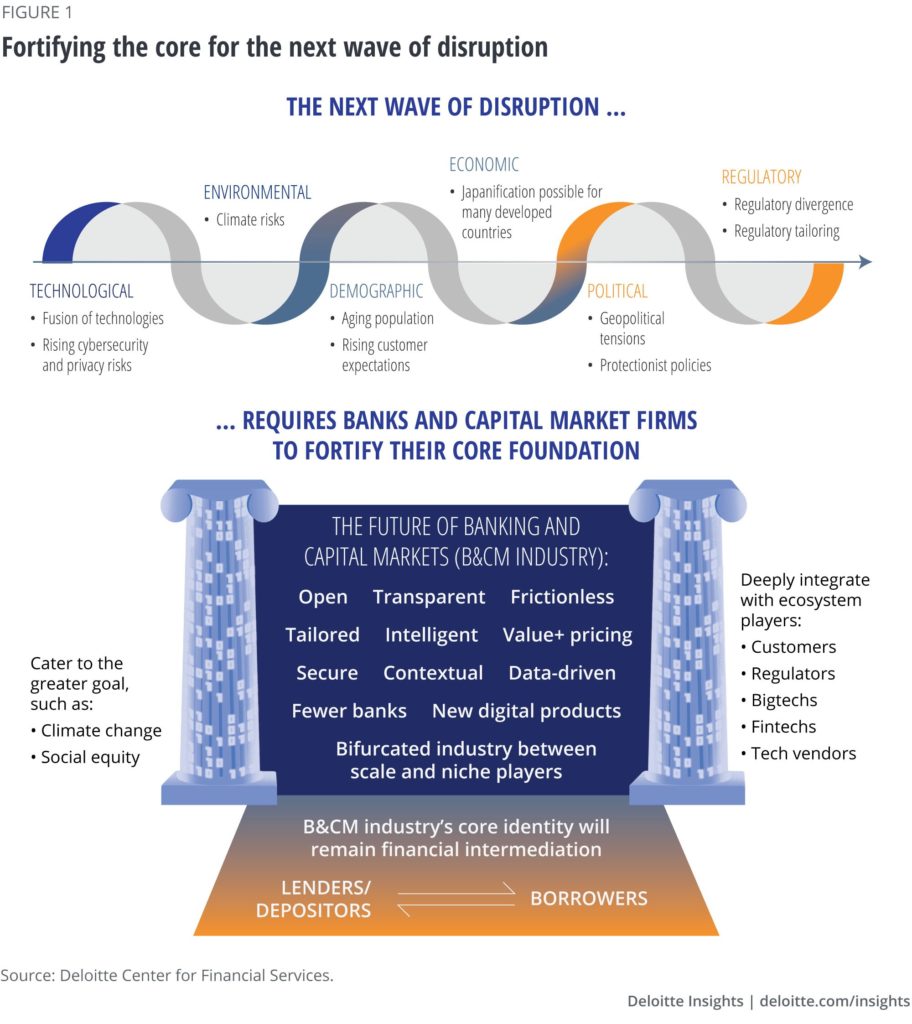

Before I share my thoughts and vision on the future of banking here is an interesting report by Deloitte that simply brings together all elements in the next big wave of transformation approaching us.

This famous saying by Bill Gates inspired me to take a giant leap of thought and glide into a supernatural world to imagine things beyond what’s happening already in the field of Banking and Financial Services.

For a moment – Let me take you on a ride into this imaginative and futuristic world and I hope you enjoy this exaggerated big-picture (rather, fantasy) of how banks will look down the lane so – Buckle-up!

My ‘Unrealistically’ Practical Vision for Banking

It’s a fact that wearables are an in-thing now, but what if these get embedded as implants!

Don’t you think the entire gamut of “banking” would be re-defined in that scenario? Will the banks even exist? How will we get to save money? Thought-provoking questions right?

Here is an interesting video I came across and I guess this is where we are headed – check it out!

Let me help you stretch your imagination beyond that. Now picture a world where:

- Your currency will be ‘time’, just like in the movie – ‘In Time’ where the time before one dies is what’s being bartered to buy any stuff. Or,

- Imagine a scenario like in the movie ‘Black Mirror’. Where your efforts will be equal to rewards. Hence, people who are more physically active become richer and richer! Or,

- Maybe we get to trade our mind and thousands of years of knowledge with Aliens to earn for our planet and make it liveable!

Sounds unrealistic? But I think this is possible. The future does hold some mind-blowing transformations and I strongly believe with technologies like Artificial Intelligence disrupting things around us it is taking us closer towards the – unimaginable!

What’s Happening Today in The Banking World?

When the bubbles of our thoughts pop the world significantly starts looking more attractive. But it’s good to do a reality check and see how we get to achieve what we have imagined as the ‘future of banking’.

Here is an interesting video by Henri Arslanian, Chairman of the FinTech Association of Hong Kong (FTAHK).

In this video, Henri shares how FinTech is getting revolutionized and how various companies in the world are adopting machine learning and artificial intelligence to change the way they do business and so, there is a dire need for the banks to transform as well.

The key pointers from his talk that caught my attention:

- Artificial Intelligence is impacting Peer-to-Peer lending, Blockchain, Cross Funding, Digital Payments, and giving us our Robo Advisors.

- Facebook, WhatsApp, and other social media app have adopted a strategy to enable fund transfers from their apps and that is making money transfer so easy.

- The cross-selling strategy is getting dynamic so the exclusivity of banks to perform a transaction is getting diluted.

I am sure today if you want to transfer money to someone in India you will not go to the bank, rather you will choose to pull out your phone and make a transfer using Unified Payments Interface (UPI). It’s simple, fast and super convenient.

How is Artificial Intelligence Impacting the BFSI Sector?

The most intriguing question which I am sure everyone in the BFSI world would love to know about. So let’s jump-in to explore that.

1. AI and Credit Decisions:

Unlike a human being, a machine will not be biased. AI enables a faster and cost-effective assessment of a potential buyer. AI enables lenders to distinguish between high-risk applicants and applicants who lack extensive credit history.

Here is a use-case of a financial firm in the US that has incorporated Machine Learning to enable auto lenders to acquire more borrowers at a lower cost.

BFSI and NBFCs are moving towards using “alternative data” for lending. Federal Bank defined “alternate data” as ‘Information not typically found in the consumer credit files of the nationwide consumer reporting agencies or customarily provided by consumers as a part of applications for credit’.

Tomorrow, just your retina scan will give a holistic picture of your entire net worth, liabilities, purchase habits, peers, travel habits and more. Getting molecular on the whole is the next new!

2. Fraud Detection using Artificial Intelligence

“Payments fraud continues to soar, as a record 82 percent of organizations reported incidents in 2018, according to the 2019 AFP Payments Fraud & Control Survey, underwritten by J.P. Morgan.” –

There is a need for real-time fraud detection as fraud attacks are getting more sophisticated and fraudsters are up-skilling themselves to take this game notches higher.

So, here is a case study of how Danske Bank fought fraudsters with Teradata’s Artificial Intelligence and Deep Learning solution. According to the case study, Teradata helped Danske Bank modernize its fraud detection process and reduce its purported 1,200 false positives per day.

Here is how it benefited the bank:

- They achieved a 60 percent reduction in false positives, with an expectation to reach as high as 80 percent.

- There was an increase in true positives by 50 percent.

Now that’s a significant achievement. According to them – ‘‘the system to make autonomous decisions in real-time that aligned with the bank’s procedures, security, and high-availability guidelines. The solution provided new levels of detail, such as time series and sequences of events, to better assist the bank with its fraud investigations”

3. Artificial Intelligence in Stock Trading

“Artificial intelligence is to trading what fire was to the cavemen” – as quoted by an industry expert.

Again going back to my futuristic views, I can foresee the future with AI in trading to be a mind-blowing one. Just picture AI taking all the big data to analyze and suggest the best shares to buy and sell in a fraction of seconds and all of that suggestion is bound to be right because they are data-driven insights.

Well, in that case, you will become a billionaire in a matter of a few minutes. This technology is disruptive. A Hong Kong company Aidiya, led by Ben Goertzel started a hedge fund that performed all operational transactions through Artificial Intelligence solely, without any intervention of humans.

“If we all die, it’ll continue to trade,” — Goirtsel remarked and I guess that’s what’s gonna happen in the future – Machine to Machine trading!

4. Artificial Intelligence in Compensation Management:

Whether you are a banking personal, third-party agents, HR, Operations, IT & outsourced business partners, collection agencies, verification agencies, marketing agencies or even salaried professionals, your compensation hike will now be based on your next-years performance! Yes, you got me right – Your NEXT years performance!

This is fairly a complicated process. It has three critical components – Data, Technology and most importantly People.

I understand working on getting the pay right is absolutely important but there are certain aspects of compensation that can be downright frustrating, I have heard Human Resource personals say things like:

- “I don’t know which surveys I should be using to price this job – it’s a brand new position!”

- “I don’t have the data for this city in the survey”

- “I have formulated a process and come up with a range for this role but my hiring manager says the range is too low”

If you have worked in compensation management these will be relatable statements. But hey! AI is here to save your day.

“With high power dynamic models, AI can analyze the job requirements using big data and give out results based on the adequate pay scale in a matter of seconds. The models today are designed to take into account the freshness of data into consideration while projecting the findings.”

AI models today also identify the most significant factors impacting pay and thereby optimizes its results accordingly. If you ask me what’s happening here in by 2030 then I would simply say – Your boss will be an AI robot and he will decide your pay and compensation. So we are sorted here!

Conclusion:

There are a plethora of possibilities for Artificial Intelligence to transform our world beyond our imagination. I mean, look at the Indian landscape, I recently saw a completely digital bank branch by SBI in Delhi and with all process automated and no soul around it was a one-of-its-kind futuristic banking experience.

Besides that, I believe in the current landscape where applications like Paytm, PayPal, etc, are diversifying into providing banking services the gap between banking and non-banking sectors is shrinking and who knows tomorrow we might end up having a one-stop-shop for purchasing our groceries to opening a fixed deposit.

My thoughts are also sliding on the chatbot revolution. While everything is automated tomorrow you might be talking to a virtual bank CEO who is actually a robot but with a human touch. To help you imagine that I will leave you with a video below.

And, another rage of Fintech approaching us, where every other firm will be a fintech firm providing exactly what banks are providing. For example, Apple just launched its credit card! I mean, a computer company launching a credit card is simply mind-blowing. Banks need to buckle up and look for ways to retain their customers by adapting the next-gen digital transformations.

Drop your thoughts and imaginations of the futuristic technologies that you foresee in the world of Fintech in the comments section below. I would love to ride along with you on this!